Dividend stocks have been around for more than 400 years.

In the 1600s, the infamous Dutch East India Company (VOC) became the first public company to pay a regular dividend. Since then, dividend-paying stocks have become a staple of public markets.

Today, about half of U.S. stocks pay regular dividends to shareholders, accounting for about 40% of total stock market returns since the 1930s.

In this article, we’ll look at three good reasons to invest in dividend stocks, some of the most iconic stocks, and how you can build your passive income portfolio.

Why Invest in Dividends?

The best-performing stocks over the past decade are high-growth tech stocks like Apple, Microsoft, and Amazon. So, why should you consider investing in dividend stocks?

Income

Generating passive income is the most popular reason for investing in dividend stocks. Rather than waiting to sell, dividend stocks offer monthly or quarterly income. For example, retirees may use dividend stocks to generate income without bonds. And many FIRE (Financially Independent Retire Early) practitioners rely on dividend stocks for part of their income.

Inflation

Dividend stocks offer shelter from inflation. In the 1940s and 1970s, dividend-paying stocks accounted for 65% and 71% of the S&P 500’s total return, respectively. That’s because they’re usually profitable businesses that don’t rely on debt when interest rates rise in response to inflation. And many can pass on higher costs to their customers.

Safety

Dividend stocks offer shelter from inflation. In the 1940s and 1970s, dividend-paying stocks accounted for 65% and 71% of the S&P 500’s total return, respectively. That’s because they’re usually profitable businesses. Also, they may not rely on debt which gets expensive when interest rates rise in response to inflation. And many can pass on higher costs to their customers.

Iconic Stocks & Funds

Thousands of stocks pay dividends, but a few have achieved cult status among dividend investors. On Twitter (#divtwit) and Reddit communities, Realty Income Corp. (O) and the Schwab U.S. Dividend Equity ETF (SCHD) reign supreme.

Realty Income Corp. (O)

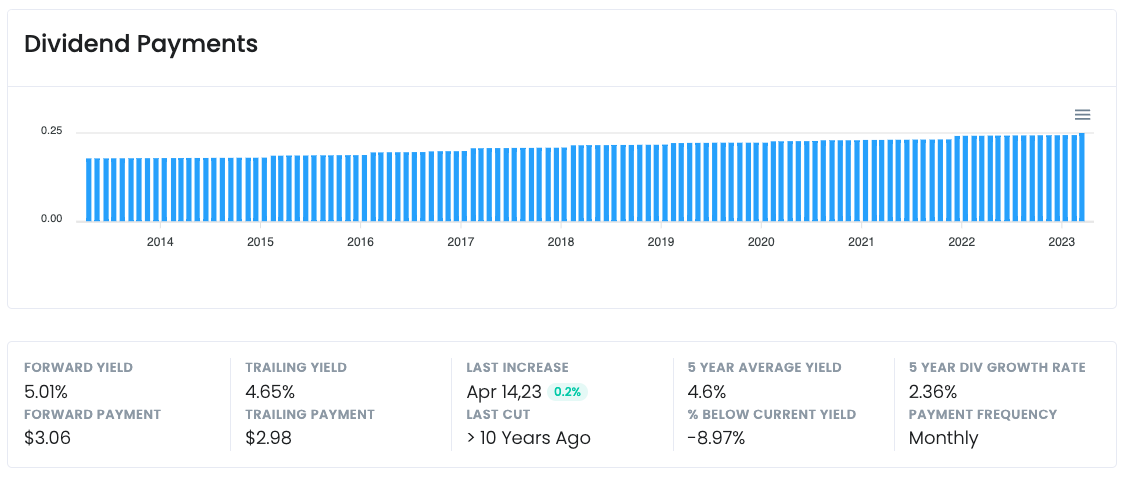

Realty Income Corp. (O) is perhaps the most popular dividend stock, having branded itself The Monthly Dividend Company™. The REIT owns over 6,500 real estate properties under long-term lease agreements with commercial clients and pays a reliable monthly dividend. Over the past 50 years, it has made over 600 consecutive dividend payments.

Schwab U.S. Dividend Equity ETF (SCHD)

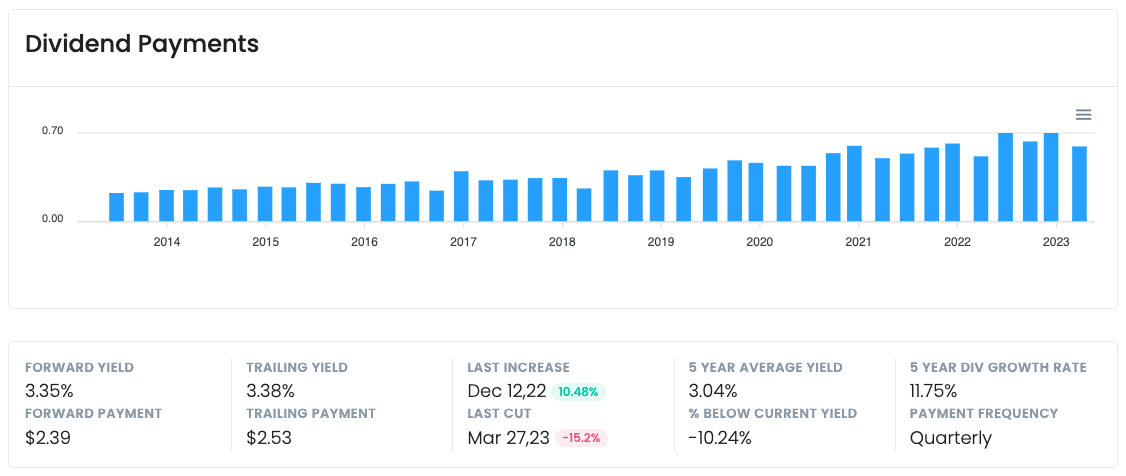

The Schwab U.S. Dividend Equity ETF (SCHD) is a market-cap-weighted fund including companies with a 10-year history of paying dividends. The fund uses fundamental screens – such as cash flow to debt and dividend yield – to build a portfolio within this universe. Individual stocks can’t be more than 4%, and sectors can’t be more than 25% of the portfolio.

Stock Picking Strategies

These two iconic dividend stocks offer diversification and high-income levels but aren’t the only way to build passive income. Since the 1990s, the Dogs of the Dow approach has produced compelling gains while Dividend Reinvestment Plans (DRIPs) offer individual investors an opportunity to cost-effectively build positions in individual stocks.

Dogs of the Dow

Michael B. O’Higgins’ Dogs of the Dow strategy involves picking the top ten highest-yielding dividend stocks from the Dow Jones Industrial Average. These companies are typically at the bottom of their business cycle because their low share price creates a high yield. As a result, the strategy promotes both income and value.

Dividend Reinvestment Plans

Some public companies offer dividend reinvestment plans (DRIPs). Rather than taking the dividend, these plans reinvest the dividend proceeds into the company’s stock. In addition to avoiding transaction fees, many DRIPs offer a 3% to 5% discount on the price of the newly acquired stock, creating an opportunity to buy even lower.

Some of the most popular DRIPs include:

- Aqua America (WTR)

- Ventas Inc. (VTR)

- Lockheed Martin Inc. (LMT)

- Healthcare Realty Trust (HR)

Taking a DIY Approach

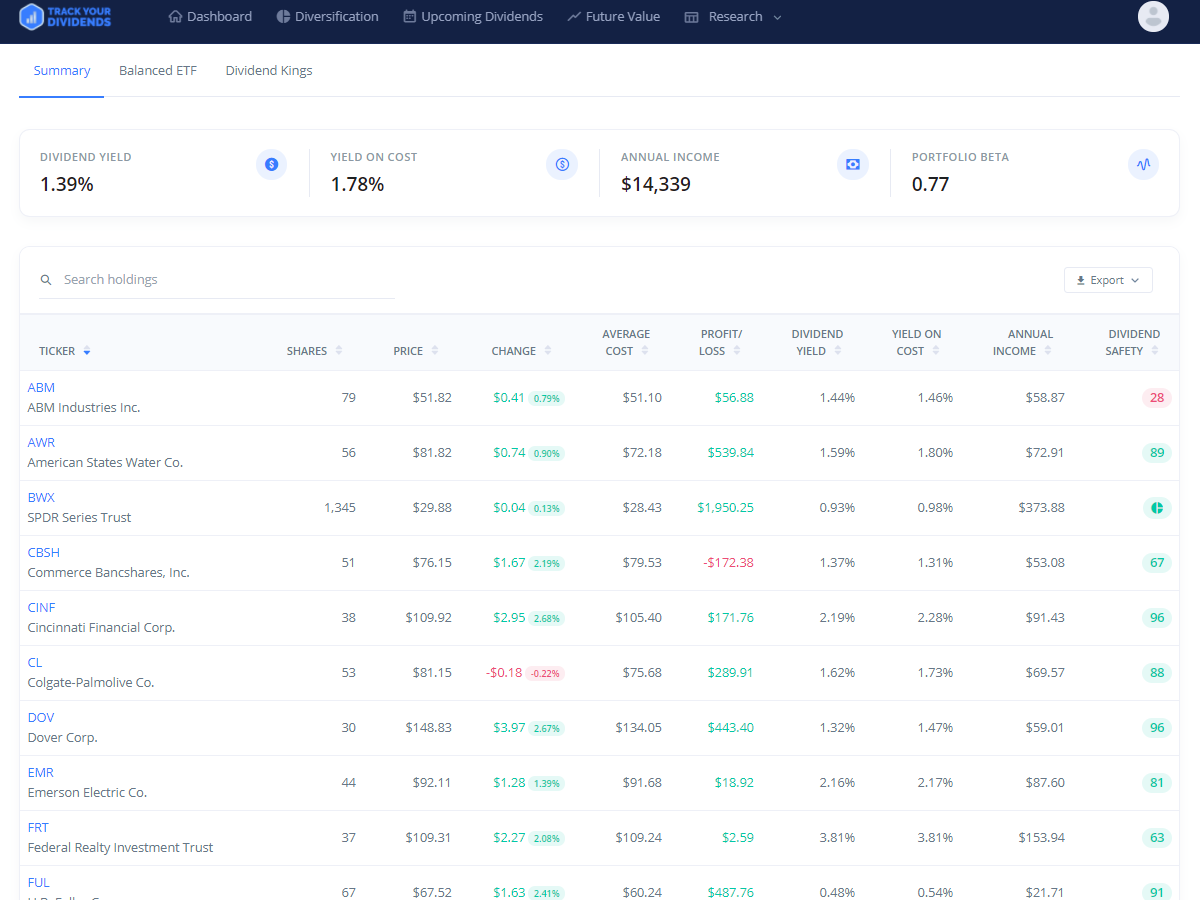

Investors seeking more flexibility may choose to build a portfolio from scratch. When doing so, dividend screeners and portfolio trackers can help you access the information you need to make decisions and keep tabs on your positions over time.

There are several factors to look for when screening for dividend stocks:

- Dividend Yield – The dividend yield determines how much income you generate (assuming the dividend is paid in full and on-time).

- Dividend Safety – A dividend’s safety depends on factors like its dividend coverage ratio – its cash flow per share divided by its dividend per share.

- Quality & Value – A stock’s quality and value influence the risk of a price decline or future dividend cuts. So, you might want to look at factors like the debt-to-equity ratio or price-earnings ratio to assess quality and value.

- Technical Trend – Finding stocks with a positive technical trend can help avoid value traps – or stocks that look cheap but actually have hidden factors making the market weary. But technical analysis shouldn’t be the only driving factor.

In addition, you should monitor your portfolio on an ongoing basis by watching factors like:

- Annual Income – Monitoring annual income can help you conceptualize risk and quantify your goals. For example, you might consider diversifying into new areas if you make most of your income from one stock or sector.

- Yield on Cost – Yield on cost provides the most accurate income picture. By dividing the price you paid for the stock by the current dividend, you can see how much you’re yielding based on your cost basis rather than the market price.

- Average Cost Basis – Your average cost basis shows, on average, how much you paid for a stock. Using this information, you can calculate your taxable gains and compute your yield on cost or other metrics.

- Profit or Loss – You should always track your gain or loss on a position, even if you buy for dividends. After all, you can sell losing positions to harvest tax losses and offset any capital gains or up to $3,000 worth of ordinary income each year.

The Bottom Line

Dividend stocks are a great way to generate passive income and insulate your portfolio from inflation and economic downturns. While O and SCHD are two popular options, there are many strategies you can use to find optimal dividend-paying stocks. But be sure to monitor your portfolio over time to understand your income and ensure safety.

If you trade dividend stocks, TrackYourDividends.com can help you research companies and monitor your portfolio. You can easily create alerts for upcoming dividends, compute your portfolio’s future value, or find new opportunities with in-depth research tools. Create your free account today!

And if you’re looking for other ways to generate income, Snider Advisors can help you leverage covered calls. These strategies provide income on top of dividends by writing call options against your long stock positions. Take our free e-course to learn more today!