Dividend investing seems easy on the surface: You find stocks with a high yield and invest in them to build income over time. But, of course, these high-yield stocks need to continue paying dividends over time. And the underlying stock needs to remain stable or, ideally, grow over time. Otherwise, you could lose money on these investments. In this article, you’ll learn about the dividend payout ratio and how it can help determine whether a company’s dividend is sustainable.

What is a Dividend Payout Ratio?

The dividend payout ratio is simply the total amount of dividends a company pays to its shareholders relative to its net income or earnings.

Dividend Payout Ratio = Dividend per Share (DPS) / Earnings per Share (EPS)

You can calculate the dividend payout ratio by dividing a company’s annual dividend per share by its annual earnings per share. Or alternatively, you can divide the total dividends paid by its net income. Either way, the ratio of dividends to income should be the same (or a rounding error).

For example, suppose a company had earnings of $10 per share and paid a $1.50 quarterly dividend. Its dividend payout ratio would be 60% (($1.50 x 4 quarters) / $10 = 60%).

Dividend Payout Ratio vs. Dividend Yield

Many novice investors confuse a company’s dividend payout ratio with its dividend yield – an easy mistake with such similar names!

We’ve already seen that the dividend payout ratio divides a company’s dividend amount by its net income. In other words, you’re determining the percentage of a company’s profits that it pays out as a dividend to shareholders. You can look at it as the “margin of safety” for the dividend or the company’s “generosity” in sharing profits.

On the other hand, a company’s dividend yield divides its annual dividend by its price per share. The metric tells you your expected rate of return from dividend payments (although not capital gains). So you can look at it as a way to compare the “profitability” of different dividend stocks and compute how much income you can expect to receive per dollar invested.

What It Means for Dividend Investors

The dividend payout ratio is a critical metric for income investors.

The metric is most helpful in measuring dividend sustainability. For example, if a company’s payout ratio is more than 100%, it returns more money to shareholders than its earnings, which may not be sustainable. Generally, investors should seek companies with payout ratios below 60% or 70%, leaving room for earnings fluctuations and potential dividend increases.

Dividend payout ratios can also help you compare companies in the same industry. For example, a utility company with a lower payout ratio than its peers could suggest less confidence in earnings power or a focus on capital gains growth rather than income. Other companies, like REITs, must distribute at least 90% of their earnings.

Finally, established companies with a lot of free cash flow and low dividend payout ratios could become a target for activist hedge funds. For example, Apple Inc. began paying dividends after its 0% payout ratio became indefensible amid its record cash stockpile. As a result, these companies could become opportunities for income investors.

Finding or Calculating Dividend Payouts

Financial websites provide the easiest way to find a company’s dividend payout ratio. For example, on Yahoo! Finance, you can visit a company’s Statistics page and scroll down to the Dividends & Splits section to find its Payout Ratio and other dividend-related data points. But, of course, some websites are easier to use and more helpful than others.

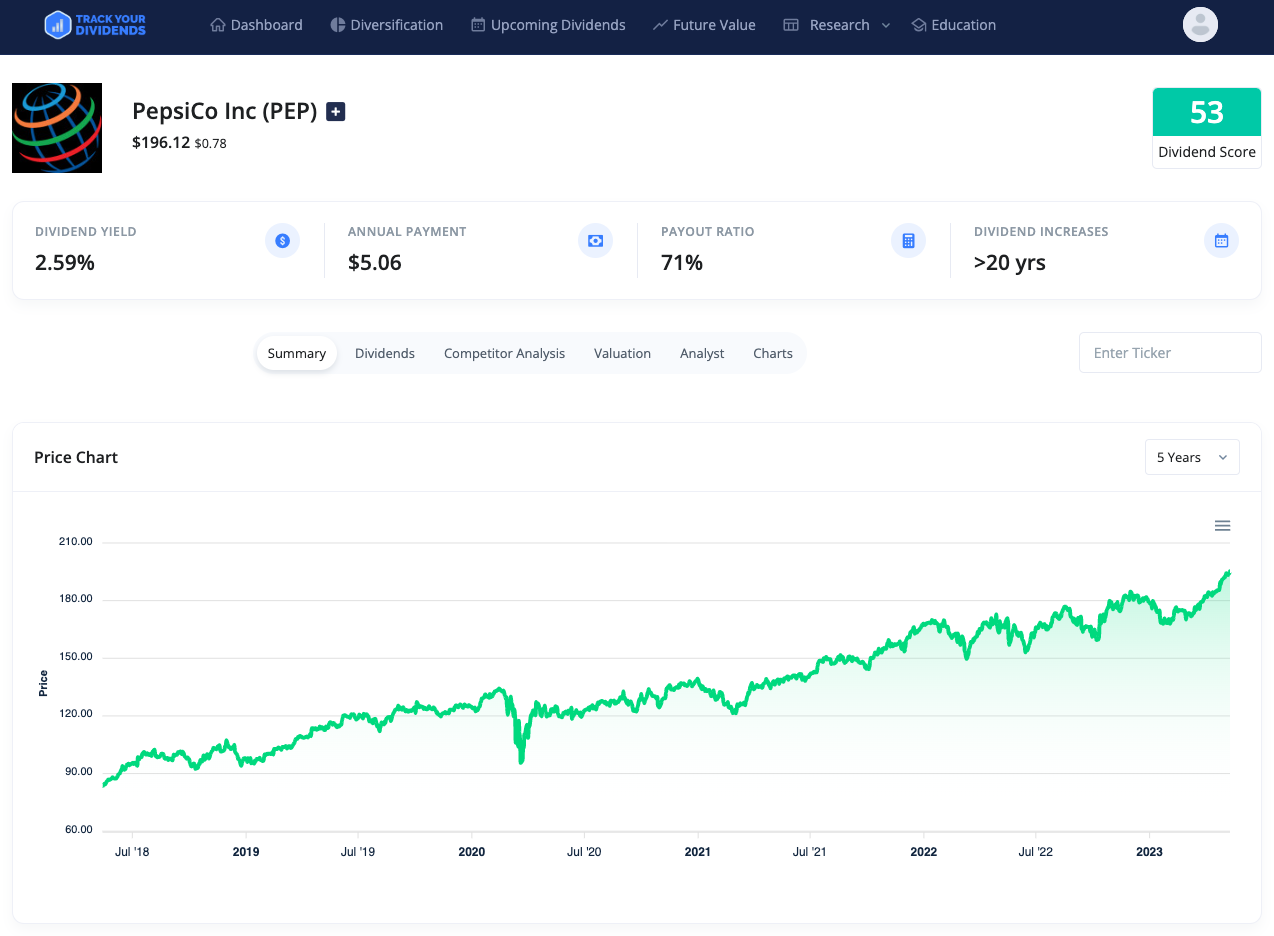

TrackYourDividends shows the payout ratio front and center. Source: TrackYourDividends

Using TrackYourDividends, you can quickly see any company’s dividend payout ratio by visiting the Stock Analysis dashboard and typing in a ticker symbol. You can also find helpful information like the dividend yield, annual payment amount, and years of dividend increases. And it’s free to sign-up and start using these purpose-built dashboards.

Other Metrics Investors Should Monitor

The dividend payout ratio is just one of many metrics to consider when looking at potential opportunities. For example, you may also want to factor in dividend yields to ensure you earn enough income or quality metrics to reduce a stock’s downside risk. But, of course, the exact metrics you use depend on your objectives and risk tolerance.

Some other metrics to consider include:

- Dividend Yield – The dividend yield expresses your annual return from income (excluding capital gains). As discussed, you can use this metric to compare different opportunities or calculate your expected income from dividends.

- Beta Coefficient – The beta coefficient reflects a stock’s risk relative to the overall market. Higher beta coefficients could jeopardize future dividends or stock valuations compared to lower readings, making it an important measure of risk.

- Yield on Cost – The yield on cost calculates a “dividend yield” based on your cost basis rather than the market price. In other words, it reflects how much you make with your existing assets at your blended purchase price.

- Free Cash Flow – Free cash flow is a company’s cash flow from operations less its capital expenditures. If a company has no free cash flow, it cannot finance dividend payments, so investors should always look for growing free cash flow.

- Debt – Financial leverage is a double-edged sword. If a company has a high debt-to-capital ratio, future dividend payments could be jeopardized by rising interest costs. But efficient use of leverage can help boost dividend yields.

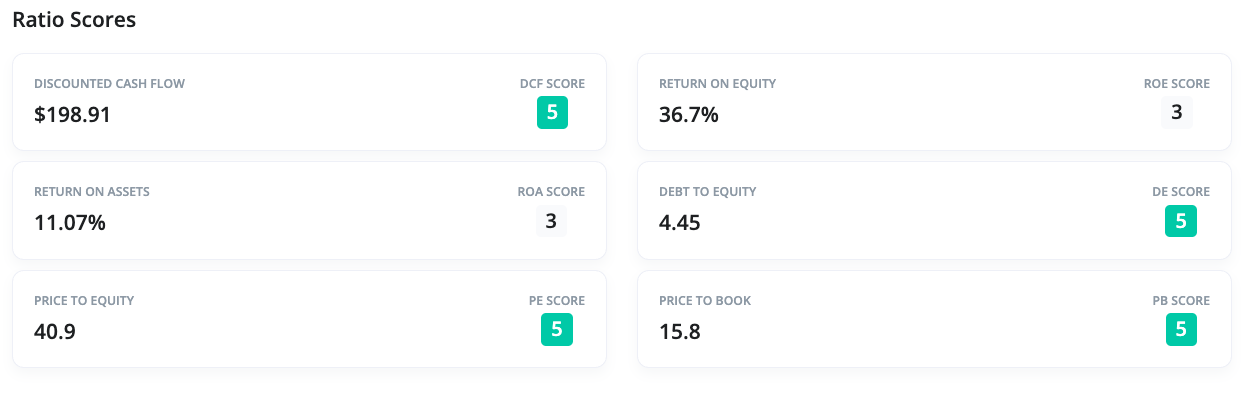

TrackYourDividends provides many metrics for dividend investors to consider. Source: TrackYourDividends

TrackYourDividends provides a broad range of financial metrics you can use to compare, analyze, and invest in dividend stocks. For example, the platform provides many of the most common financial ratios (see above) and numerical scores to easily compare them.

The Bottom Line

Dividend payout ratios are an essential metric for income investors. By comparing a company’s dividend payouts to its net income, you can quickly determine if its dividend is sustainable over the long haul. But, of course, payout ratios aren’t the only metrics that dividend investors should consider – they’re just one part of a larger analysis.

If you’re interested in dividend investing, TrackYourDividends can help you analyze new opportunities, track your overall portfolio, and estimate your income growth over time.