Dividend stocks are essential to many income-focused portfolios, but comparing them with other fixed-income investments can be challenging. Fortunately, dividend yields provide a standard of measure, making it easier to optimize your portfolio. But how do you calculate dividend yields, and should you look at more than just the headline number?

In this article, you’ll learn how to calculate and use dividend yields to build an optimal income-focused portfolio.

Understanding Dividend Yields

Dividend-paying stocks offer regular monthly, quarterly, or annual income while providing the potential for stock price appreciation.

But how do you compare one dividend-paying stock with another? What about different types of income-generating investments like bonds?

Dividend yields provide a standard measure for comparing different income-generating securities. For instance, you can easily compare a dividend yield with a bond yield, understand the income potential of each option, and determine where to invest to maximize income.

However, dividend yields don’t account for the risks associated with a particular investment. While a stock may have a high dividend yield, it doesn’t guarantee that the company will be able to make those dividend payments. Dividend yields should only be one of many metrics used in your decision-making process.

It’s also important to remember that a company’s dividend yield can change over time as the stock’s market price fluctuates and the company adjusts its dividend payout. Moreover, the dividend yield doesn’t account for any potential gains or losses due to stock price changes.

How to Calculate Dividend Yields

Dividend yields are pretty straightforward to calculate. And, if you want to save time, the most popular financial portals will compute dividend yields for you.

You can calculate a stock’s dividend yield by dividing its annual dividend per share by the current stock price. You can find the annual dividend per share in a company’s financial statements or by going through past press releases.

Dividend yield = (Dividend per Share / Price per Share)

For example, suppose a company pays an annual dividend of $2.00 per share and trades with a $50.00 per share stock price. To find the dividend, you’d use the following calculation:

Dividend Yield = ($2 / $50) = 4%

If you buy and hold the company’s shares for a year, you can expect a 4% return on your investment from dividends alone, assuming its dividend policy and the stock price stay the same.

Interpreting Dividend Yields

Dividend stocks with the highest yield may be tempting, but they’re rarely a good income investment. For instance, the stock price may have been cut in half due to poor earnings, resulting in a sky-high dividend yield that the company is unlikely ever to pay.

There are several factors influencing dividend yields:

- Dividend Policy – Companies prioritizing paying high dividends to shareholders often have higher yields.

- Regulations – Some industries inherently offer higher yields for regulatory reasons. For instance, real estate investment trusts (REITs) must distribute 90% of their net income.

- Stock Price – Dividend yields are inversely proportional to the company’s stock price. So, if all else remains equal, an increasing stock price leads to a lower dividend yield and vice versa.

- Market Conditions – Companies may cut dividends during economic downturns to preserve cash or increase dividends in prosperous times to attract more shareholders.

- Company Performance – A company that’s performing well and generating high profits may elect to increase its dividend payouts, which can increase the dividend yield.

In addition to considering the factors influencing dividend yields, it’s essential to remember that dividend yields are only half of a stock’s total return. A dividend stock that offers a 6% yield and 0% appreciation may be a worse investment than a dividend stock offering a 3% yield and 10% appreciation, depending on risk and your objectives.

Although dividends aren’t guaranteed, they can be estimated with a lot greater accuracy than price appreciation. A true total return can’t be calculated until after the fact. Historically, dividends have accounted for nearly 40% of the gains in the S&P 500. Building a stock portfolio focused on income remains a solid, time-tested investment approach.

Tools & Resources

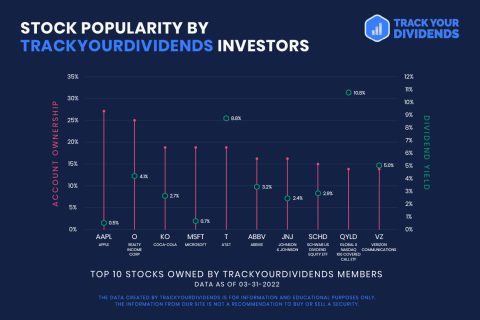

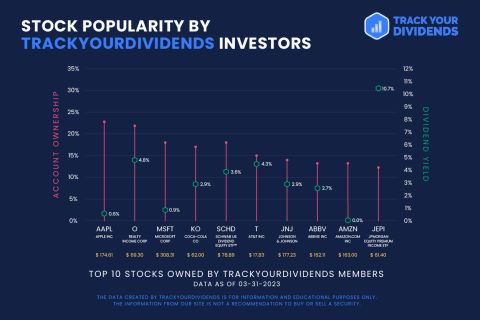

Many tools and lists can help you find high-yielding dividend stocks. For instance, the widely circulated S&P 500 Dividend Aristocrats list offers a helpful starting point for those seeking high-quality dividend payers. But the challenge isn’t finding high-yield opportunities – it’s identifying the ones that align with your investment goals and risk tolerance.

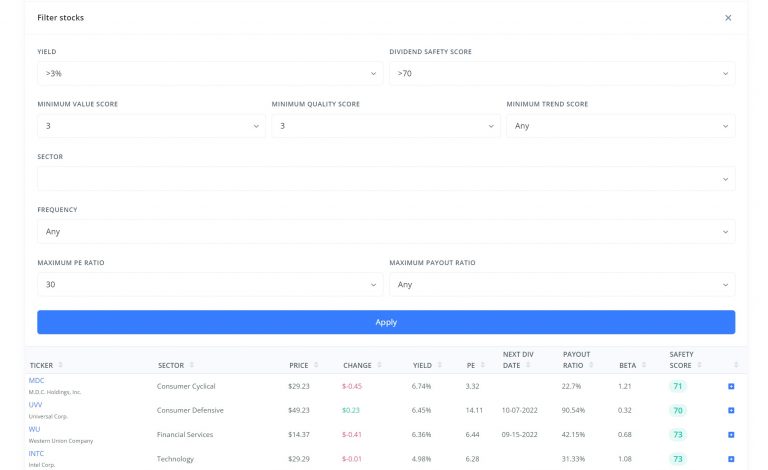

Specialized stock screeners provide a more tailored approach. These online tools enable you to filter stocks based on various criteria, including dividend yields, payout ratios, and years of consecutive dividend increases. You can customize your search to match your investment needs, risk tolerance, or other requirements.

TrackYourDividends makes it easy to screen for stocks based on a variety of popular and niche criteria, including dividend safety or dividend frequency. Source: TrackYourDividends

TrackYourDividends.com offers one of the few dividend-focused screeners and tracking solutions. You can use the screener to filter opportunities based on conventional criteria like dividend yield or unique criteria like the proprietary dividend safety score. Then, you can track your portfolio and see your income projections and other metrics.

The Bottom Line

Dividend yields provide a helpful standard for the comparison of dividend stocks and other fixed-income investments. However, they’re just one part of the equation. You should also consider a stock’s upside potential and risk factors before making any decisions. And screeners like TrackYourDividends.com can help you make an informed decision.