Dividends are an essential component of many investment strategies. Whether you’re a seasoned investor or just starting, keeping track of dividend payouts is crucial to understanding your performance. But if you hold tens or hundreds of stocks with varying dividend schedules, it can be challenging to stay on top of every payout.

Dividend notification emails can help ensure that you get all the dividend payments, providing you with the information you need to make informed investment decisions.

In this article, we’ll delve into the importance of tracking dividends, offer general guidelines for setting up notifications, and show you how to utilize TrackYourDividends to stay up to date.

Why You Should Track Dividends

Many investors are drawn to dividend stocks for their income, but they also provide key insights into a company’s stability and health. They often reflect a company’s earnings and its confidence in future profitability. Companies that regularly increase their dividends are almost always profitable and have high visibility into their future earnings.

Knowing this, there are several reasons to track dividends:

- Reinvestment Opportunities – By tracking dividend payouts, you can strategically reinvest the proceeds, harnessing the power of compound interest.

- Income Tracking – Many investors rely on dividends to provide a steady source of income, especially during retirement. Monitoring dividend payments can help with financial planning and budgeting efforts.

- Informed Decision-Making – Regularly receiving and analyzing dividend data can offer insight into a company’s performance, helping you decide whether you should buy, hold, or sell a stock.

On the other hand, if you fail to monitor dividends, you could miss if a company changes its dividend policy and sees significant fundamental changes too late.

Setting Up Dividend Notification Emails

Not many brokers provide dividend notification emails or messages. TrackYourDividends specializes in these dividend alerts and provides more context to help you make informed decisions. While brokers serve all kinds of customers, we’ve built TrackYourDividends from the ground up to specialize in analyzing and tracking dividend-paying stocks.

Let’s see how to get started:

Connect Your Accounts

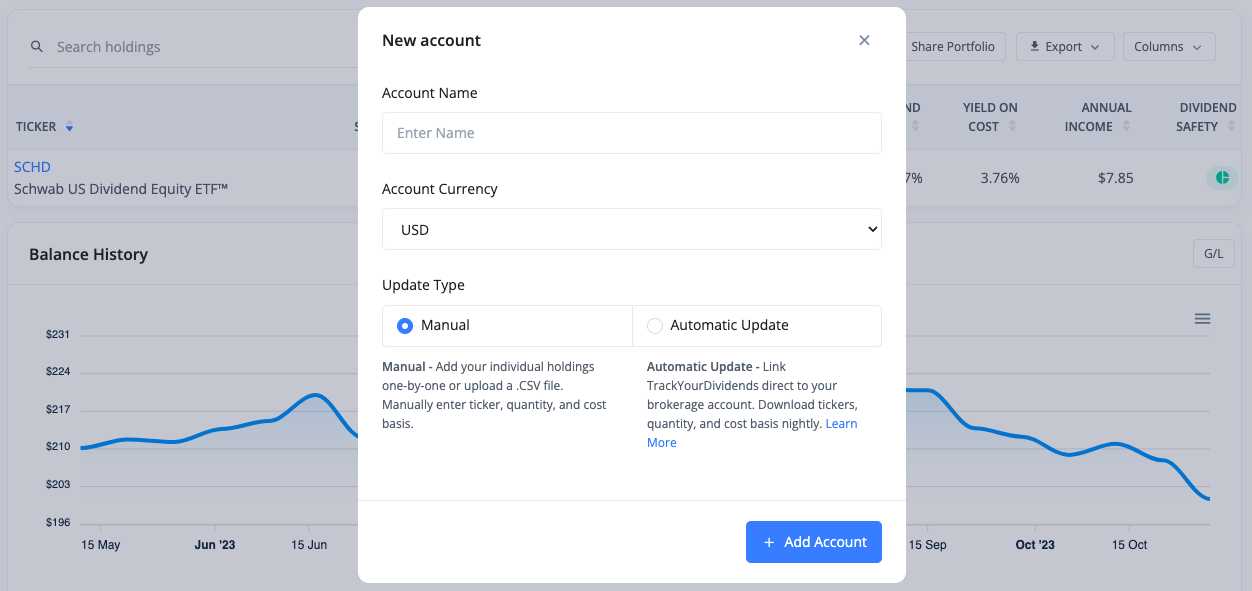

TrackYourDividends automatically syncs with hundreds of the most popular brokers, making it easy to stay up to date with any changes to your portfolio. But, if you use a more obscure brokerage or prefer not to sync your accounts, you can also manually input individual holdings one by one or by uploading a CSV file.

View Upcoming Dividends

The Upcoming Dividends tab provides a wealth of information, including a visual chart showing when to expect upcoming dividends and a payout calendar showing confirmed dividends. You can also see the average, highest, lowest, and variance of dividends at a glance, making it easy to understand how much you’ll receive and when to expect it.

Setup Dividend Notification Emails

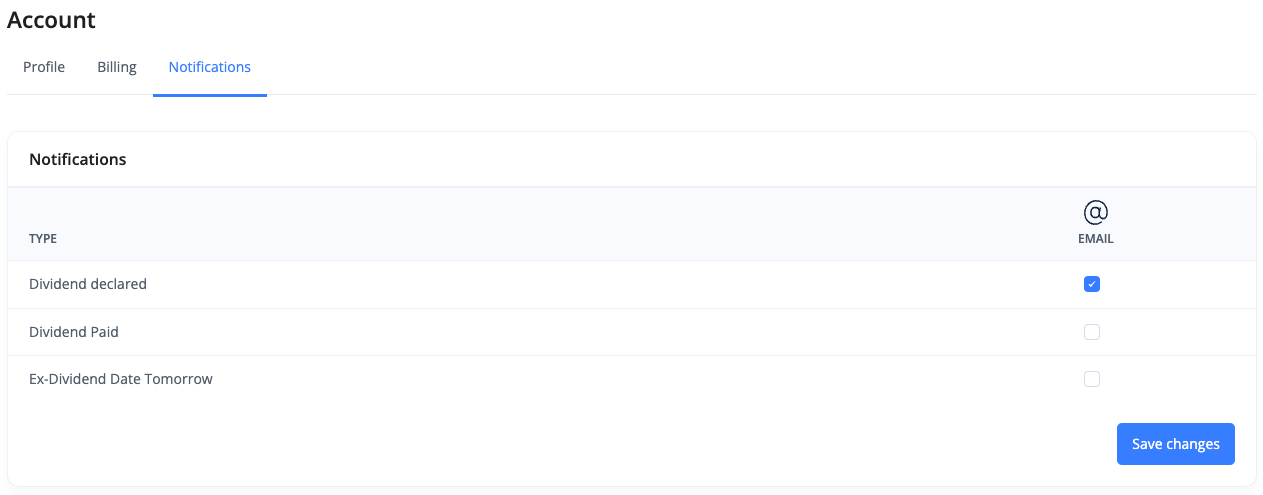

You can click on the Set Dividend Alerts button on the Upcoming Dividends page or click on your profile picture in the upper-right corner and select Profile and Settings and then Notifications to start configuring dividend notification emails. On this screen, you can select which notifications you’d like to receive.

The three options are:

- Dividend Declared – Dividend declarations occur when a company’s board of directors officially indicates that a dividend will be distributed to shareholders. By knowing when to expect these dividends and how much they will be, you can better anticipate income and plan to reinvest any dividends. And, of course, if there’s an unexpected dividend cut, you may choose to re-evaluate the fundamental merits of the stock.

- Dividend Paid – The dividend payment event marks when the actual dividend is distributed to shareholders. You might track these events to know when the dividend hits your bank account and to ensure that you properly update your records.

- Ex-Dividend Date Tomorrow – The ex-dividend date is the cut-off date established by the stock exchange to determine which shareholders are eligible to receive the dividend. If you buy on or after the ex-dividend date, you will not receive the upcoming dividend. As a result, this is an essential notification to let you know your last day to add to a position to ensure you receive the dividend payout you expect.

Other Tips for Tracking Your Dividends

Dividend notification emails are just one part of the bigger picture. TrackYourDividends makes it easy to analyze your dividend portfolio to ensure that it’s meeting your income expectations, as well as balancing risk and reward properly.

Let’s take a look at some additional features that you may want to consider when building and managing your dividend portfolio.

Diversification

Investors face two types of risks in the market: Systemic and non-systemic. While systemic risks are difficult to avoid, you can mitigate non-systemic risks through diversification. By holding a variety of stocks across different sectors and industries, you can mitigate the impact of a poor-performing stock or sector on the entire portfolio.

TrackYourDividends makes it easy to assess your level of diversification on an asset allocation level, as well as in terms of sectors and industries, in the Diversification tab. In addition, you can see if you’re over-reliant on a single stock or ETF for your dividend generation – adding a unique level of insight specific to dividend investors.

Future Value

Many dividend investors focus on current income, but part of the allure of investing in stocks is the potential for long-term equity appreciation. By applying a dividend growth rate, price appreciation rate, and other factors, you can project how much income you’ll generate by a target date – such as your retirement date.

TrackYourDividends makes these calculations simple in the Future Growth tab. After inputting your starting values, we automatically compute your dividend growth over time to help you plan contributions to reach your target income levels over time.

Research

The research process for dividend stocks differs from growth stocks or value stocks. Rather than looking at factors like growth potential or book value, dividend investors focus on metrics like payout ratios to assess dividend sustainability and dividend increase to determine the likelihood of a company continuing to increase dividends over time.

TrackYourDividends provides a plethora of research tools to help you in your dividend-investing endeavors. Using the Stock Analysis tool, you can quickly find high-yielding REITs, assess their safety score, and view everything from the payout ratio to analyst opinions. Meanwhile, a fully featured screener can help you find the ideal opportunities in just a few clicks.

The Bottom Line

Dividend tracking is essential to the success of any dividend investor – and not just to track your anticipated income. Dividend email notifications can help you discover when companies are altering their dividends (a potentially bad omen) and let you know when to invest more to qualify for a dividend without missing the ex-dividend date cut-off.

If you’re looking for dividend email notifications, TrackYourDividends provides one of the most robust options on the market with support for dividend payout, dividend declaration, and ex-dividend date email notifications. And, of course, you also have access to an unparalleled set of tracking and analysis tools to help you.