Covered call ETFs have become more popular over the past few years as their yields move into the double digits. If you’re not familiar with the options strategy, you may be wondering how it works, what the risks are, and what funds offer the best opportunities.

In this article, we’ll provide the answer to these questions, show you some of the most popular and highest-yielding options, and conclude by looking at some alternatives to consider.

How Do Covered Call ETFs Work?

Covered calls may sound complex to those without options experience but they’re one of the simplest and lowest risk strategies.

Covered call ETFs, also known as buy-write ETFs, write call options against a long portfolio to generate income. If the stocks rise above the option’s strike price, the fund owes the option buyer the difference between the stock price and strike price. But if the price declines or stays below the strike price, the fund keeps the premium paid by the option buyer.

The funds typically pass on the premium to their shareholders, creating a more attractive yield than dividends, real estate, or even fixed-income funds.

Types of Covered Call ETFs

Covered call ETFs have two important variables:

- They own different indexes or portfolios of underlying stocks

- They write call options with different strike prices and expiration dates

Most covered call ETFs purchase a long index and write call options against the index. For example, the Global X S&P 500 Covered Call ETF (XYLD) owns the S&P 500 index components and writes a short S&P 500 call option against those holdings. Generally, these are at-the-money options designed to generate the most income.

Other funds build their portfolio of stocks and write call options against individual stocks or adjust the options to provide room for capital gains growth. For instance, the popular JPMorgan Equity Premium Income ETF (JEPI) invests in a custom portfolio with similar characteristics to the S&P 500 and writes out-of-the-money S&P 500 index call options.

Should You Invest in Covered Call ETFs?

Most investors are drawn to covered call ETFs by high yields, which often exceed those of dividend stocks and are on par with fixed-income securities. Since call option premiums increase with volatility, these yields rise when the market becomes more volatile.

The funds also have less volatility than the broader market, which is a side-effect of the volatility premium. If the stock market moves lower, covered call premiums offset the drop in the long stock portfolio, resulting in a buffered loss. And if the market moves higher, covered call funds can benefit from some capital appreciation if they sell out-of-the-money calls.

Of course, the drawback is that they cap upside potential. Strong bull markets may provide investors with double-digit yields, but they miss out on a significant amount of capital gains. And in some cases, the higher income fails to offset the lost price appreciation.

Covered call ETF distributions are also subject to income tax at your marginal tax rate, whereas capital gains may fall under the lower long-term capital gains tax rate.

Most Popular Covered Call ETFs

| Name | Ticker | Assets (AUM) | Expense Ratio | Yield |

| Global X NASDAQ 100 Covered Call ETF | QYLD | $7.7 Billion | 0.60% | 11.97% |

| Amplify CWP Enhanced Dividend Income ETF | DIVO | $2.9 Billion | 0.55% | 4.80% |

| Global X S&P 500 Covered Call ETF | XYLD | $2.8 Billion | 0.60% | 10.85% |

| Global X Russell 2000 Covered Call ETF | RYLD | $1.5 Billion | 0.60% | 12.73% |

| iShares 20+ Year Treasury Bond BuyWrite Strategy ETF | TLTW | $837 Million | 0.35% | 18.46% |

*Data as of December 5, 2023

Highest Yielding Covered Call ETFs

| Name | Ticker | Assets (AUM) | Expense Ratio | Yield |

| KraneShares China Internet and Covered Call Strategy ETF | KLIP | $118 Million | 0.95% | 56.96% |

| Credit Suisse X-Links Crude Oil Shares Covered Call ETN | USOI | $320 Million | 0.85% | 22.04% |

| iShares 20+ Year Treasury Bond BuyWrite Strategy ETF | TLTW | $837 Million | 0.35% | 18.46% |

| iShares High Yield Corporate Bond BuyWrite Strategy ETF | HYGW | $48 Million | 0.69% | 16.00% |

| Global X Russell 2000 Covered Call ETF | RYLD | $1.45 Billion | 0.60% | 12.37% |

*Data as of December 5, 2023

The notable caveat to the high dividend yields in these funds is that past performance doesn’t guarantee future performance. For example, in the case of KLIP, Chinese internet stocks have seen a significant decline with the KraneShares CSI China Internet ETF (KWEB) having fallen about 16% between January and early December 2023. Also, investors should also be cautious when investing in funds with limited assets under management (AUM). Be careful with any fund under $300 million AUM.

How to Choose the Best Option

Investors have access to more than 30 different covered call ETFs leveraging different strategies and covering various parts of the market.

So, how do you choose between them?

First, ensure that the covered call ETF contains the right asset type for your portfolio. For example, if you’re looking for a fixed income allocation, you don’t want a covered call ETF that holds growth stocks. Instead, you may prefer a bond-based buy-write strategy.

Second, you should also consider the composition of the ETF’s long portfolio and ensure it’s within your risk tolerance levels. For instance, a Nasdaq 100 index may be tech-heavy and riskier than the S&P 500 index with its greater industry-level diversification.

And finally, you should carefully consider each fund’s expense ratio and liquidity. Generally, actively managed ETFs have higher costs than their passive counterparts. And whether they’re worth the extra cost depends on their risk-adjusted performance.

Covered Call ETF Alternatives

Covered calls aren’t the only option for investors seeking income from options. Some ETFs use cash-secured puts, or other similar option strategies to boost income.

The WisdomTree PutWrite Strategy Fund (PUTW) sells two put options on the S&P 500 with different expiration dates each month. Unlike selling call options, the put options obligate the fund to purchase the S&P 500 at a specific price before an expiration date. As a result, the fund holds Treasuries and generates income by selling the options.

On the other hand, the Aptus Collared Investment Opportunity ETF (ACIO) combines covered calls with long put options to provide downside protection. So, for example, investors can generate a little extra income without worrying about significant downside.

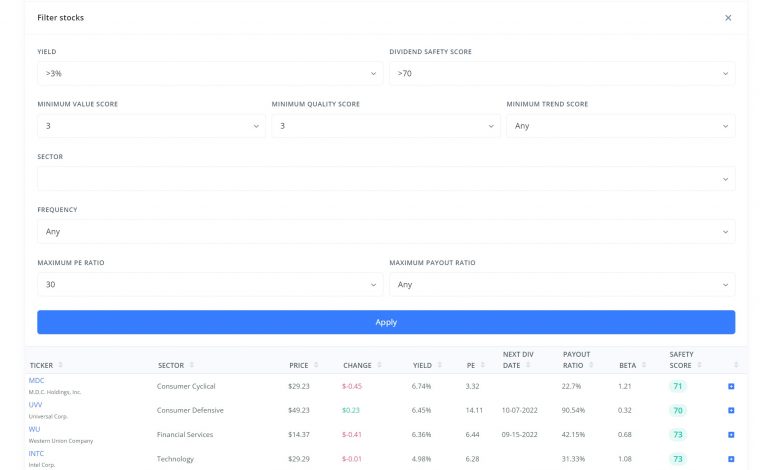

TrackYourDividends.com makes it easy to screen for stocks based on their yield, dividend safety, valuation, and other factors. Source: TrackYourDividends.com

Of course, you can also invest in more conventional dividend stocks instead. Using tools like TrackYourDividends.com (above), you can find high-yielding opportunities without the capped upside of covered calls while researching the risks associated with each company.

These aren’t mutually exclusive options either–you can write covered calls against dividend stocks. If the option buyer doesn’t call the option away, you can keep both the dividend and the option premium, providing an even greater income boost!

The Bottom Line

Covered call ETFs are an excellent way to boost income by selling call options against long stock positions. While you give up some capital gains potential, the strategy can generate higher yields than dividend stocks and are comparable to fixed income in some cases.

If you’re looking to boost your portfolio income, TrackYourDividends.com can help you find the best dividend opportunities and project your income from distributions over time.