Dividend investing is one of the best ways to generate consistent income for retirement – but tracking that income can be a challenge. Early on, you want to know how much you need to save to reach your income targets. And later in life, you need to plan your dividend distributions to cover housing, food, healthcare, and other expenses.

In this article, you’ll learn how to monitor your dividend investments and how to find the right dividend trackers for your requirements.

How Do You Monitor Dividends?

Monitoring dividends sounds simple on the surface: You just record the income you receive from each dividend-paying stock in your portfolio.

But there are two problems.

First, you need a way to automate the process. It can be cumbersome to check a portfolio every day for dividend distributions and manually add them to a spreadsheet.

Second, you need actionable insights. A list of dividend distributions isn’t very helpful. You need to know things like:

- How much money am I making each month or year?

- What is my portfolio’s overall dividend yield?

- How safe and reliable are those dividends?

You generally have two choices to monitor dividends:

- Spreadsheets – Spreadsheets provide the most flexibility since you can easily customize them to deliver the insights you want. But they’re difficult to set up, maintain, and automate.

- Dividend Trackers – Dividend trackers simplify the entire process, but many don’t provide as much flexibility as spreadsheets. As a result, it’s worth investing some time in finding one that provides the insights you need.

What’s the Best Dividend Tracker?

Most people start their dividend tracking journey on their brokerage’s website. For example, using Robinhood, you can go to Account > Settings > History > Dividends and see your received and scheduled dividend payments.

Unfortunately, most brokerages have very limited dividend tracking capabilities.

You’ll need a dedicated dividend tracker to unlock most insights and even connect to multiple accounts if you want to track holistic dividend income.

Some key questions to ask when choosing the right dividend tracker include:

- How much does it cost? Some dividend trackers are free while others have a subscription. When choosing between options, weigh the cost of these services against the benefits they provide you to make a sound decision.

- Can you track multiple accounts? If you have multiple accounts, you’ll want to house all your information in one place rather than setting up several trackers.

- Is there a dividend calculator? Dividend calculators can help you project your income over time to enhance financial planning and manage income.

- Can you configure notifications? Dividend notifications tell you when dividends hit your account or when you need to purchase a stock to qualify for a dividend.

With these factors in mind, let’s take a look at a few different options.

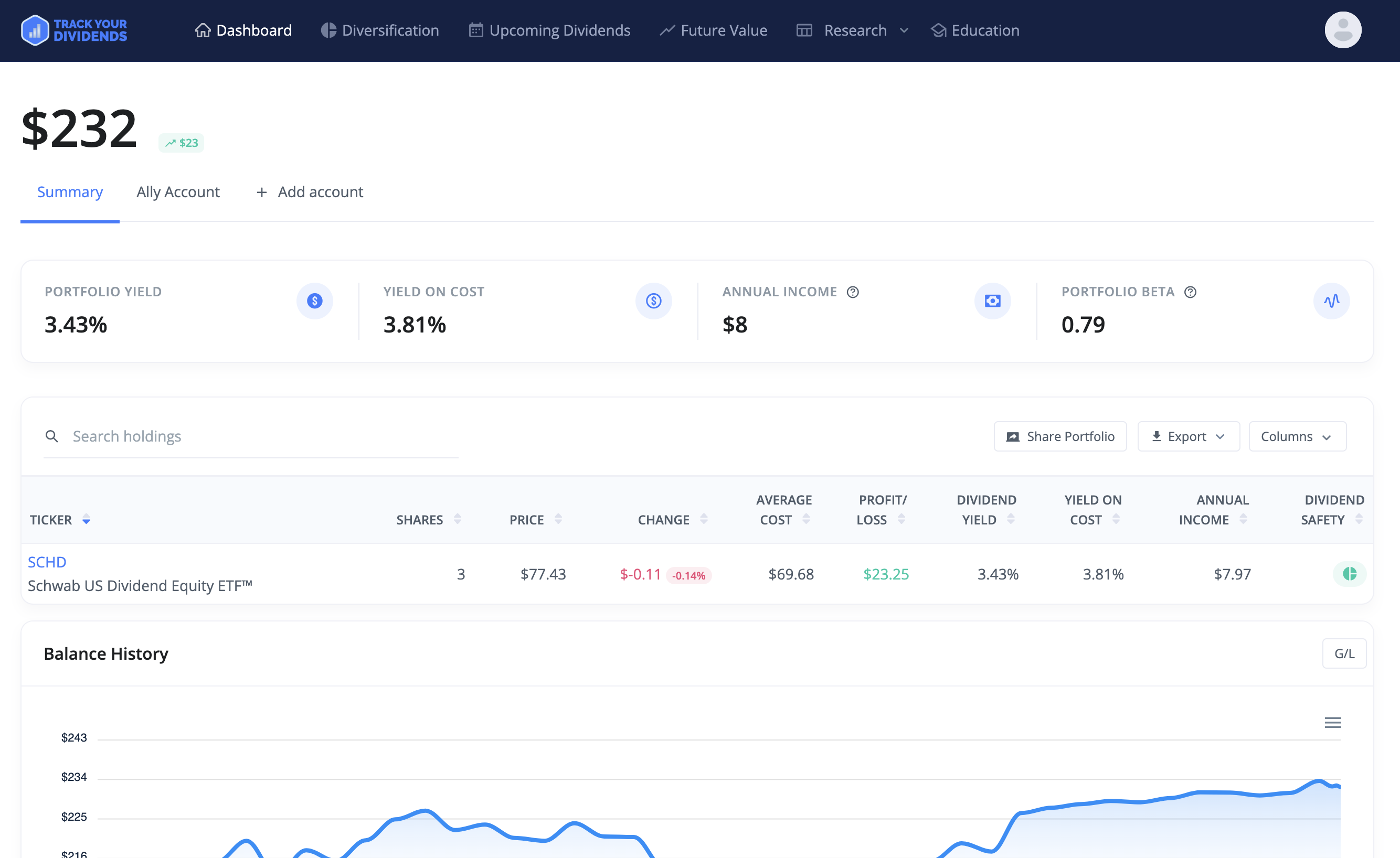

TrackYourDividends: Best All-Around

TrackYourDividends is one of the best online dividend trackers available. While we may be a little biased, we’ve worked day and night to deliver the features we’ve always wanted in a dividend tracker. And the result is above and beyond other dividend tracking apps.

TrackYourDividends shows you everything you need to know in one place.

Some features setting TrackYourDividends apart include:

- Annual Income – Quickly see the annual income you’ll generate from your dividend portfolio along with the timing of each dividend payment throughout the year.

- Future Value – Easily see how much your portfolio could be worth (and payout) each year based on dividend growth, price appreciation, and annual contributions.

- Diversification – Spot-check your portfolio’s diversification to ensure that you’re not overly exposed to individual sectors or asset allocations.

Our platform also offers extensive dividend research capabilities. You can screen for dividend stocks based on factors like yield, dividend safety, quality, value, trend, sector, and more. You can also access pre-built idea lists such as Dividend Aristocrats, S&P 500 stocks, or High Dividend Low Volatility stocks.

And finally, it’s free to link one account and access many of these tools. If you want more power, you can subscribe for $9.99 per month or $99.99 per year. Sign up for free.

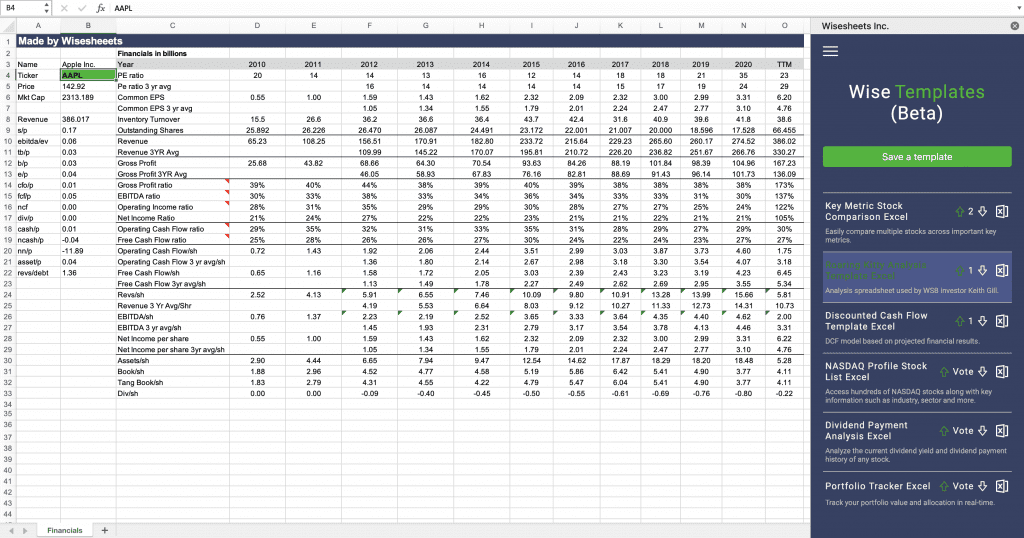

WiseSheets: Best for DIY Investors

Some investors want more control than any dividend tracker app could provide, but manually inputting dividends is error-prone and time-consuming. Fortunately, WiseSheets lets you easily add financial data to Microsoft Excel or Google Sheets.

Wisesheets works from within your spreadsheet application. Source: Wisesheets.io

With WiseSheets, you can build a custom spreadsheet containing the exact information you need to know. For example, if you have developed a proprietary dividend safety score, you can compute that score using WiseSheet’s financial data. Or if dividends are just one factor in your decisions, you can incorporate all your other factors in one place.

WiseSheets’ pricing is $60 per year for most data or $120 per year for faster data speeds, priority support, and additional screener functionality. Learn more

DivTracker: Best for iPhone Users

DivTracker offers a free iOS app to track your dividends. As a mobile-first option, it’s best for those who exclusively track stocks on their phone. You can easily connect popular brokerage accounts and see everything in one place.

DivTracker is a simple iPhone app that makes it easy to track your dividends. Source: DivTracker

The iOS mobile app features:

- Automatic Integrations – Connect your brokerage account and import your portfolio to see a consolidated summary of dividends.

- Dividend Calendar – Easily visualize your projected and realized monthly dividend income with an intuitive dividend calendar.

- News & Updates – Access the latest news from a variety of sources to stay well-informed and up-to-date with dividend insights.

While DivTracker isn’t as fully featured as the other two options, it’s free for iOS users and offers a great mobile alternative! Try it out today!

Other Dividend Trackers

- The Dividend Tracker – The Dividend Tracker provides dividend alerts, dividend calculators, and a mobile app to track your dividends. You have the option of a basic free account or a $12.50 per month premium account (billed annually).

- Simply Safe Dividends – Simply Safe Dividends is a pioneer in the space, launching its dividend tracker in 2015. In addition to the usual tools, the platform focuses on dividend safety. But it costs a hefty $499 per year.

- Dividend.com – Dividend.com is a broader financial portal focused on dividends with tools for tracking dividends. While the tracker is great, the website’s real value is in its analysis tools with 40+ years of dividend history.

The Bottom Line

Tracking dividends may seem trivial, but without the right tools, it can quickly become tedious and time-consuming. Fortunately, dividend tracker apps or spreadsheet enhancements can help simplify and automate the process while delivering actionable insights to help you manage your income and achieve your financial goals.