Many income investors seek out dividend stocks for their regular income and potential capital gains. While it’s possible to build and maintain a portfolio of individual stocks, dividend stock exchange-traded funds (ETFs) offer a much easier option. They provide a ready-made portfolio that’s regularly rebalanced for (usually) a relatively modest cost.

In this article, we’ll look at the largest, highest-yielding, and top-performing dividend funds and discuss how you can select the best option for your portfolio.

Why Invest in Dividend ETFs?

Most income investors turn toward fixed-income securities or dividend-paying stocks to generate income. Unlike fixed-income securities, dividend-paying stocks can appreciate in value, generating capital gains on top of any income. As a result, it’s a way to generate income without necessarily drawing down your portfolio in retirement.

By investing in dividend ETFs, you don’t have to worry about rebalancing your portfolio regularly. For example, if one stock increases in value, it might account for a large percentage of your portfolio and introduce too much risk. So, you may need to sell that stock and buy other stocks to ensure you have the right level of risk.

Dividend ETFs do this for you for a relatively modest fee. The Vanguard Dividend Appreciation ETF (VIG) contains more than 300 individual stocks. If one stock appreciates in value, the fund managers automatically rebalance the portfolio to maintain the right exposure for just 0.06% per year (or $6 for every $10,000 worth of shares you own).

How Dividend ETFs Work

Dividend ETFs hold a basket of stocks that pay dividends, but the specific composition depends on each fund’s objective and strategy. For example, some funds might focus on stocks with the highest yields while others may target companies with a long history of dividend growth. So, it’s worth researching each fund to know what you’re buying.

The mechanics of dividend ETF distributions are like dividend stocks. The fund sets an ex-dividend date, record date, and payment date. These dates determine who receives the dividend and when it gets paid. However, the timing of these dividend payments is on a different schedule than the underlying stocks – you’ll only receive one monthly or quarterly payment.

In exchange for managing the portfolio, dividend ETFs charge an expense ratio expressed as a percentage of assets under management. For example, a 0.06% expense ratio means that the fund takes $6 for every $10,000 ($10,000 x 0.06% = $6) each year. These are taken out from the fund’s total assets daily to make it subtle and less noticeable than an annual charge.

Dividend ETFs must also follow a familiar set of tax rules. Suppose the ETF held a dividend stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date and you’ve owned shares in the ETF for more than 60 days during the 121-day period that begins 60 days before the fund’s ex-dividend date. In that case, you are eligible for qualified dividends.

Choosing the Right Dividend ETFs

While everyone wants to maximize their income, the highest-yielding ETFs aren’t always the most desirable. After all, price and yield are inversely related. If the price of a stock drops sharply – perhaps due to deteriorating fundamentals – the stock’s yield increases. And oftentimes, these stocks have to cut dividends before paying it.

Dividend ETFs also have different costs and tax exposure. For instance, active dividend ETFs may have a higher expense ratio and, if they have a lot of portfolio turnover, may have non-qualified dividends. These are dividends sold within 60 days of purchase, meaning you’ll owe ordinary income rather than capital gains tax rates on the proceeds.

A final consideration is the timing of dividend distributions. Most dividend ETFs issue quarterly dividends, but some funds offer monthly distributions, which may be more convenient for those relying on regular income to cover living expenses.

Largest Dividend ETFs

| Name | Ticker | Assets | Expense | Yield | Frequency |

| Vanguard Dividend Appreciation ETF | VIG | $73.5B | 0.06% | 1.88% | Quarterly |

| Schwab US Dividend Equity ETF | SCHD | $52.2B | 0.06% | 3.48% | Quarterly |

| Vanguard High Dividend Yield Index ETF | VYM | $50.8B | 0.06% | 3.12% | Quarterly |

| iShares Core Dividend Growth ETF | DGRO | $25.2B | 0.08% | 2.44% | Quarterly |

| SPDR S&P Dividend ETF | SDY | $20.5B | 0.35% | 2.65% | Quarterly |

Data as of January 2024.

Top-Performing Dividend ETFs

| Name | Ticker | Assets | Expense | Yield | Return (1-Year) |

| SPDR S&P Emerging Markets Dividend ETF | EDIV | $347.7M | 0.49% | 4.33% | 30.28% |

| First Trust NASDAQ Technology Dividend Index Fund | TDIV | $2.2B | 0.50% | 1.75% | 26.91% |

| Capital Group Dividend Value ETF | CGDV | $5.6B | 0.33% | 1.66% | 22.36% |

Data as of January 2024.

Highest Yielding Dividend ETFs

| Name | Ticker | Assets | Expense | Yield | Frequency |

| Global X SuperDividend ETF | SDIV | $760.6M | 0.58% | 11.82% | Monthly |

| Invesco KBW High Dividend Yield Financial ETF | KBWD | $385.2M | 2.02% | 11.48% | Monthly |

| Hoya Capital High Dividend Yield ETF | RIET | $55.8M | 0.50% | 9.51% | Monthly |

Data as of January 2024.

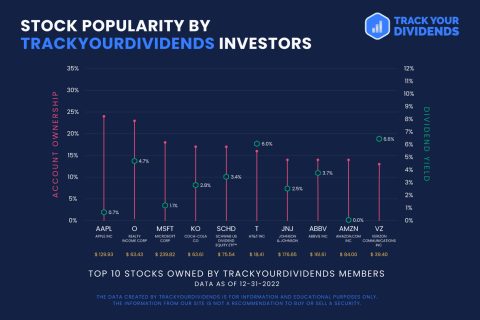

Tracking Your Dividend Portfolio

Many investors use dividend ETFs to generate a predictable income during retirement. But calculating the blended yield of a portfolio of dividend stocks and ETFs and computing your annual expected income can be a challenge.

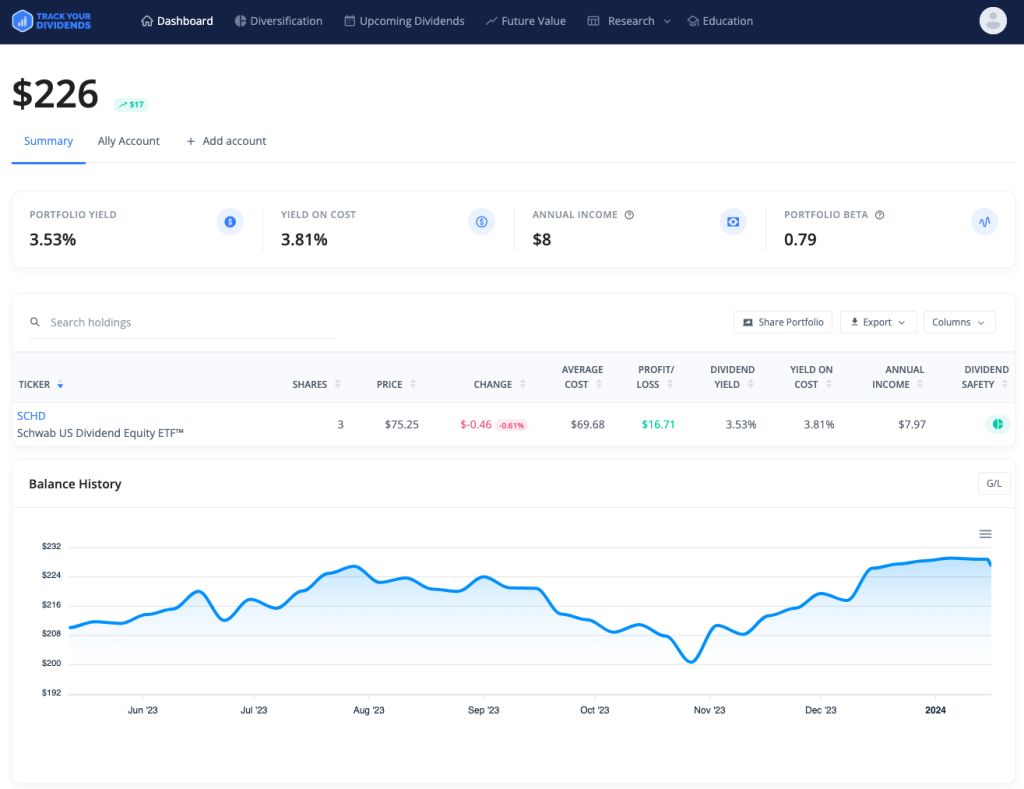

TrackYourDividends offers a helpful dashboard to get a high-level overview of your broad portfolio and dig into specific holdings. Source: TrackYourDividends

Fortunately, TrackYourDividends can help organize your portfolio and automate these calculations. You can quickly see your portfolio yield, annual income, sector diversification, upcoming dividends, and other pertinent information on a single dashboard.

You can also compute the future value of your account after putting in your expected dividend growth rate (%), price appreciation (%), and annual contributions ($). That way, you can easily see if you’re on track with your retirement income goals.

Finally, the research tool provides a dividend screener and stock analysis tool to help you find stocks and ETFs offering the best combination of yield and safety. You can also quickly see the dividend payout ratio, years of dividend increases, and other data to help you decide.

The Bottom Line

Dividend ETFs offer a convenient done-for-you portfolio of dividend-paying stocks, which income investors may find attractive to avoid drawing down their portfolios. While there are many options, TrackYourDividends can help you analyze different stocks and ETFs, and track your overall portfolio to ensure that you meet your financial goals.