Many retirees and income investors purchase dividend stocks to supplement their monthly paycheck. Unlike bonds or other fixed-income securities, dividend stocks offer both regular income and the potential for equity appreciation. This makes them an excellent way to finance retirement without sacrificing upside or drawing down a portfolio.

While dividend investing may seem straightforward, fluctuating prices and yields make it challenging to project dividend growth and income over time. And worse, these variables change for each dividend stock in a portfolio. So, creating an accurate estimate and keeping it up to date over time can quickly become a nightmare.

Fortunately, dividend calculators can help automate the process. By looking at each stock in a portfolio, they can accurately compute current dividend income and apply customized growth rates for each stock based on its historical payout. And finally, they typically aggregate these projections to help with financial planning.

In this article, we’ll look at two types of dividend calculators—dividend reinvestment calculators and DRIP calculators—and discuss the key differences. Then, we’ll show you how to quickly assess your portfolio’s income potential to better plan for retirement.

What is a Dividend Reinvestment Calculator?

Many investors reinvest their dividends into more common stock. By doing so, they compound their portfolio’s income potential over time.

For example, suppose you invest $10,000 into a stock offering a 4% dividend yield. If you don’t reinvest the dividends, you’d have a $10,000 balance and receive $400 in annual dividends year-after-year assuming no change in the stock’s price or dividend yield. On the other hand, if you reinvested those dividends, you’d have a $21,911 balance and receive $876 in annual dividends in year 21!

These differences could make a meaningful impact on your retirement. Rather than drawing down a portfolio or relying on no-growth fixed income, you could maintain a portfolio of dividend stocks and capture stock market upside. However, projecting future income from dividend stocks can be a challenge.

A dividend reinvestment calculator is a general-purpose tool that helps you model the growth of any dividend-paying investment when dividends are reinvested. In addition, many tools will aggregate these statistics across your entire portfolio of dividend-paying stocks. That way, you can determine your portfolio’s income potential in future years.

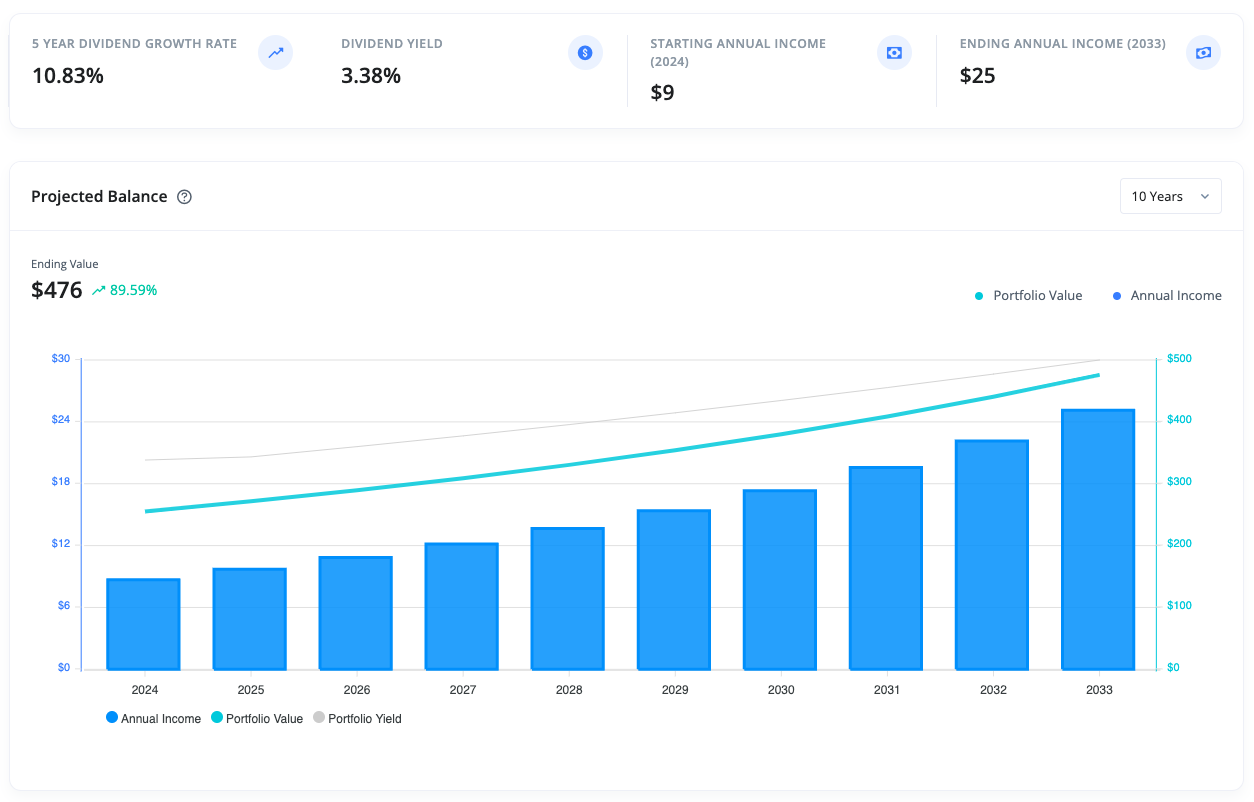

For instance, TrackYourDividends’ free dividend calculator lets you input a starting principal, monthly contribution, annual dividend yield, dividend growth rate, stock price growth rate, and maximum dividend yield. Then, you can forecast how much you’d receive in dividends each year over a specified number of years. Many tools, including a dividend DRIP calculator, also aggregate these statistics across your entire portfolio of dividend-paying stocks.

Source: TrackYourDividends

Of course, you can also connect your brokerage account and get more accurate projections based on real data. In the “Future Value” tab, you will find your portfolio’s actual five-year dividend growth rate and yield that you can use to plug in to the calculator to more accurately predict how much annual income you can expect in the future.

What is a Dividend DRIP Calculator?

Many companies offer dividend reinvestment plans, or DRIPs, to incentivize shareholders to reinvest their dividends in additional shares of stock. By doing so, investors benefit from dollar cost averaging and save money on commissions and brokerage fees. Meanwhile, companies benefit from a long-term shareholder base.

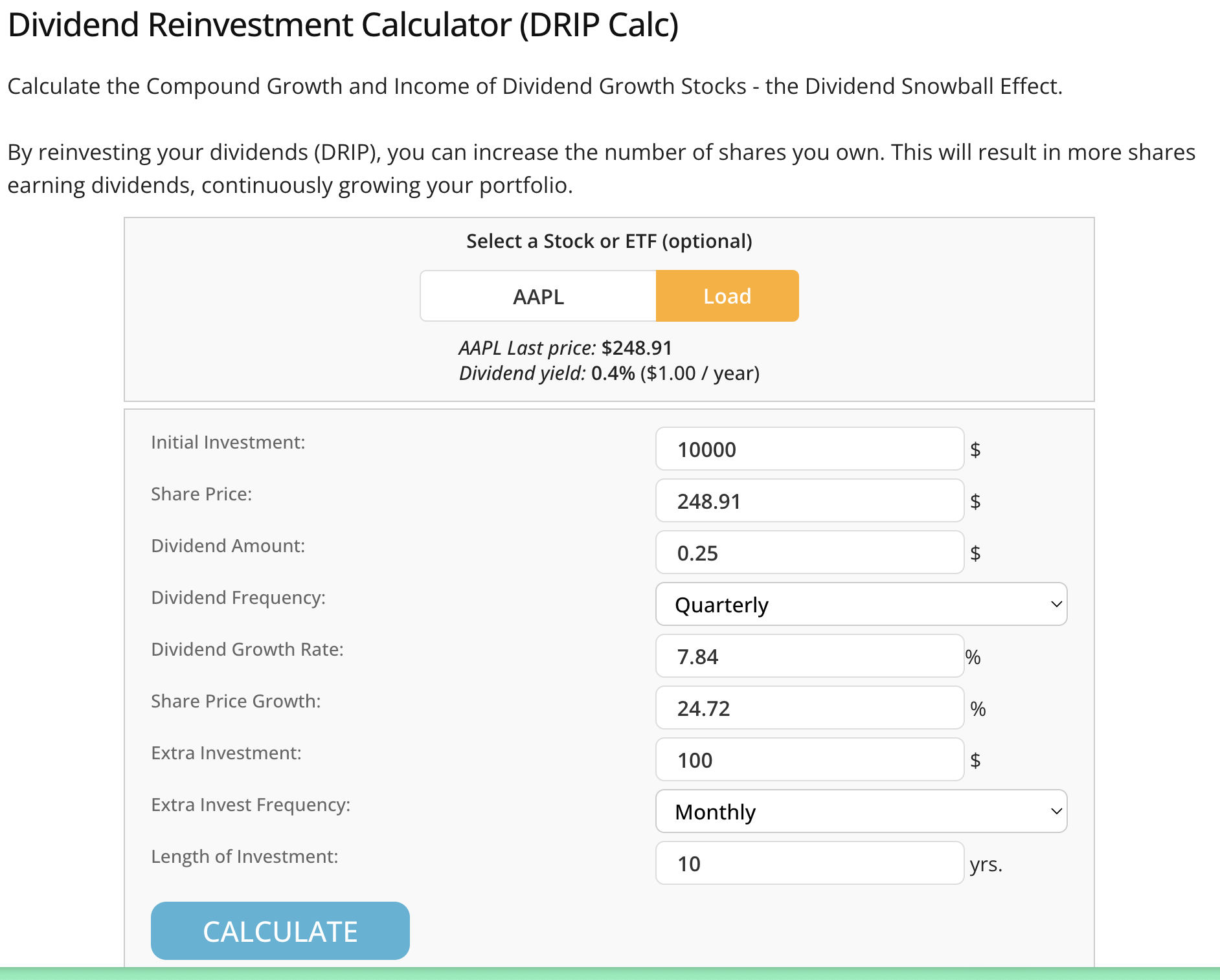

Dividend DRIP calculators are specialized tools designed to model reinvestment through these company-sponsored programs. After inputting a ticker symbol and initial investment, you could visualize the stock’s growth over time if you reinvested the dividends. The dividend growth and other factors are typically based on historical data.

Source: DRIPCalc

If you hold most of your portfolio in a single stock, such as an employer stock, these calculators can help provide an accurate estimate of your future income. Or if you have a concentrated portfolio consisting of a handful of dividend stocks, you can compute these values quarterly or yearly to get the most accurate predictions.

Key Differences Between DRIP and Dividend Reinvestment Calculators

Understanding three critical differences between a dividend DRIP calculator and a general dividend reinvestment calculator will help you choose the right tool for your investment strategy.

Specificity to Companies

A dividend DRIP calculator is tailored to specific company programs, while general dividend reinvestment calculators offer more flexibility across different investments. So, the right choice depends on the contents of your individual portfolio.

Handling Fractional Shares

Many DRIP programs involve fractional shares, whereas dividend reinvestment may be limited to whole shares. As a result, the way each calculator type handles fractional shares can lead to different projections in your reinvestment calculations.

Fees & Discounts

DRIP and general reinvestment calculators differ in how they account for various fees and potential share purchase discounts. For instance, a company provided DRIP calculator might more accurately account for these fees.

How & When to Use Each Calculator

Your specific investment situation and goals will determine which calculator type will be most useful for your planning needs. The choice between a DRIP calculator and a general dividend reinvestment calculator depends largely on your investment strategy and the level of detail you require.

When to Use a Dividend DRIP Calculator

- You’re evaluating a specific company’s DRIP program before enrolling

- The company offers special features like dividend discounts or fee waivers

- You want to model growth including exact fractional share purchases

- You need to account for company-specific reinvestment rules or limitations

- You’re comparing multiple company DRIP programs to decide which to join

When to Use a Dividend Reinvestment Calculator

- You’re reinvesting through a brokerage account rather than company DRIP

- You want to model a portfolio with multiple dividend-paying investments

- You need to compare different dividend investment strategies

- You’re making long-term projections for retirement planning

- You want to see how different yield scenarios might affect your returns

For example, if you’re considering enrolling in Coca-Cola’s DRIP program, you’d want to use a DRIP calculator to factor in their specific 1% discount on reinvested shares. However, if you’re using a brokerage account to automatically reinvest dividends from a mix of stocks, a general dividend reinvestment calculator would be more appropriate.

Consider your time horizon as well. DRIP calculators excel at showing precise short to medium-term projections with company-specific details. General reinvestment calculators are often better for long-term planning since they can more easily adjust for changing yields and market conditions over time.

The Bottom Line

Both calculator types serve valuable but distinct purposes in dividend reinvestment planning, with each being better suited to different investment scenarios.

While DRIP calculators excel at providing company-specific projections that account for unique program features, general dividend reinvestment calculators offer the flexibility needed for broader portfolio planning. The best approach often involves using both tools to get the specific information you need to make a decision.

Remember that these calculators are planning tools, not crystal balls. Their projections are based on current dividend rates and policies, which can change over time. Companies may adjust their dividend payments, modify their DRIP terms, or even suspend their programs entirely. Therefore, it’s prudent to regularly review and adjust your calculations.

If you’re looking to go beyond simple calculators, TrackYourDividends offers a variety of tools to help level-up your dividend portfolio. Get started today for free!