Dividend investing is a popular strategy for generating a steady income stream and potential capital appreciation. But, while many companies pay dividends, the best companies increase their payouts over time. These dividend growth stocks are an excellent bellwether for any investment portfolio, providing stability, regular income, and potential capital appreciation.

Let’s dive into why you should consider dividend stocks and where to find companies growing their dividends year after year.

Dividend Stocks 101

Dividend stocks regularly pay out a portion of their profits to shareholders. So, rather than waiting for a stock to appreciate and then selling it, you can participate in the company’s success over time, as it makes regular cash payments to your account.

There are a few reasons to consider dividend stocks:

- Income: Dividend payments provide a steady source of income compared to the ups and downs of buying and selling stocks for capital gains.

- Stability: Companies must be profitable to afford a dividend, so dividend-paying stocks tend to be healthier than many growth-oriented firms.

- Growth: The combination of capital gains and reinvesting dividends to purchase additional stock (e.g., DRIPs) can boost long-term returns.

But, finding the right dividend growth stocks can be a challenge.

While it’s tempting to select those with the highest yields and call it a day—dividend yields only tell part of the story. For example, a falling stock price is a surefire way to send dividend yields higher. But that doesn’t mean the stock is a screaming buy!

Building a Track Record

The decision to pay dividends typically comes from a company’s board of directors. But just because a company decides to pay a dividend one year doesn’t mean they will continue to pay. Companies might cut their dividend due to dwindling profits or when other opportunities arise.

There are a few ways to find companies committed to growing their dividends:

- Dividend History: The number of consecutive dividend payments a company has made (e.g., how many years they’ve paid a dividend without a break) may be indicative of how likely they are to continue paying a dividend.

- Dividend Growth: The number of consecutive increases in the dividend amount (e.g., how many consecutive years they’ve increased their dividend) shows their commitment to prioritizing dividends and dividend-focused investors.

- Coverage Ratio: The dividend coverage ratio reflects how “affordable” the dividend payout is for the company. You can calculate the ratio by dividing earnings per share by dividend per share, where anything below 1.5x is considered risky.

Beyond these dividend growth stock metrics, you should also consider the company’s underlying fundamentals. Companies with growing revenue and earnings—as well as strong free cash flows—are well-positioned to continue paying dividends.

Dividend Aristocrats & Other Lists

The S&P 500 Dividend Aristocrats® is a popular list that measures the performance of S&P 500 companies that have increased dividends every year for the last 25 consecutive years. The index treats each component as a distinct investment opportunity without regard to its size by equally weighting each company—but your approach may vary.

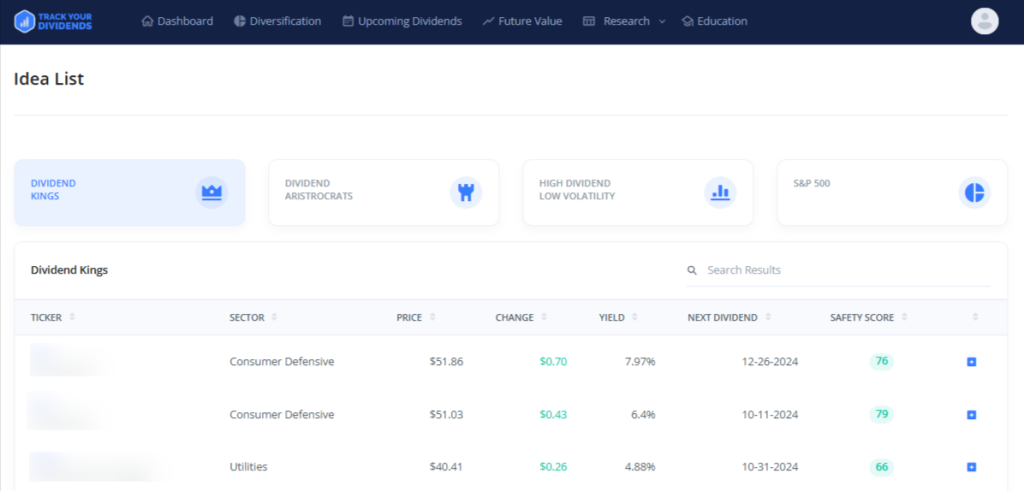

TrackYourDividends provides Idea Lists, where you can find the Dividend Aristocrats and other lists of dividend stocks, providing an excellent starting point for your research.

Other popular dividend growth stock lists include:

- Dividend Kings: Dividend Kings have increased their dividends for 50 consecutive years or more, representing the pinnacle of dividend reliability.

- Dividend Champions: Dividend Champions are like the Dividend Aristocrats in that they’ve growth dividends for 25 or more years, but the list includes companies outside of the S&P 500, including smaller stocks.

- Dividend Contenders: Dividend Contenders are companies that increased their dividends from 10 to 24 consecutive years. While they are not Dividend Champions, they are on a strong trajectory and offer growth potential.

- Dividend Challengers: Dividend Challengers are companies with a five-to-nine-year track record of growing their dividends. These are younger companies but offer an opportunity for investors looking for tomorrow’s Dividend Aristocrats.

Many investors use these lists as a starting point for further research. For instance, you may start with the Dividend Aristocrats and then filter out the opportunities to build a portfolio that matches your yield and income requirements. Or you might seek out companies that offer the most capital gains potential while still meeting yield requirements.

How to Screen for Dividend Growth

The Dividend Aristocrats and other lists offer an excellent starting point, but you still need to find the right specific opportunities for your portfolio.

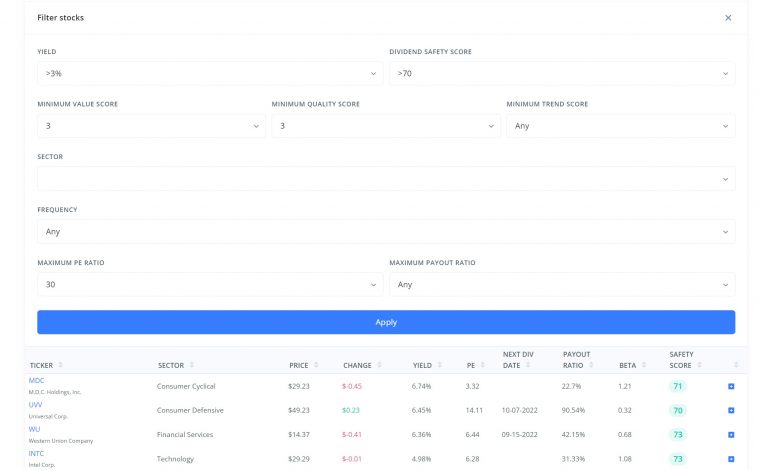

Fortunately, dividend stock screeners simplify the process by enabling you to input different criteria—such as minimum yields or maximum P/E ratios—to find the most suitable stocks for your portfolio. After all, you probably care about more than just income.

TrackYourDividends provides one of the most comprehensive dividend stock screeners in the industry. Source: TrackYourDividends

TrackYourDividends provides an easy-to-use dividend screener that filters out companies based on yield, dividend safety, value, quality, trends, sector, or other criteria. Then, you can sort the list of matches by yield, price-earnings ratio, payout ratio, beta, and safety score.

When you come across an attractive opportunity, you can add a stock to your watchlist with a single click for future due diligence and follow-up.

Some popular screening criteria include:

- Dividend Yield: You may have income requirements that necessitate a minimum dividend yield. For example, if you have a $1,000,000 portfolio and need $80,000 per year, you may need an aggregate yield of at least 8%.

- Coverage Ratio: You may want to filter out companies with a dividend coverage ratio of less than 1.5x to minimize the chances of holding a company that cuts its dividend due to the inability to make a payment.

- Earnings Growth: You may want to find companies with growing earnings to ensure dividend affordability and increase the chances of a capital gain over time.

- Debt Levels: You might filter out companies with high levels of debt since these debt servicing costs can eat into the ability to pay dividends.

Of course, these are just a handful of possibilities. The exact screening criteria that you use depends on your specific requirements and investment goals.

The Bottom Line

Dividend growth stocks are an excellent addition to any investor portfolio. Whether you’re a retiree seeking stable income or a young investor looking for profitable and growing companies, these companies are bellwether portfolio assets. By keeping in mind what we’ve discussed above, you can quickly select the best options for your portfolio.

If you’re looking for ways to track your portfolio over time, TrackYourDividends also offers a robust set of dividend portfolio tools. In addition to screening for opportunities, you can track your annual income, assess future value, and more.