Think tax laws are as exciting as watching paint dry? Think again. Understanding tax rules can pay dividends—literally, when it comes to qualified dividends.

In the world of investment income, not all dividends are created equal. Ordinary dividends and their cousin, qualified dividends, can have vastly different impacts on your wallet. But why did this distinction come about and why does it matter?

In this article, you’ll learn all about the world of dividend taxes, and by the end, you’ll see how qualified dividends could help boost your after-tax returns.

A Brief History

Dividends have been around for a very long time. Companies like General Mills and Exxon Mobil have paid dividends since the late 1800s!

Historically, dividend income was taxed at the ordinary income tax rate that varied from a top rate of 7% in 1913 to a top rate of 94% in 1944. By the 1990s, the top rate settled in at around 40% where it roughly still stands today.

But, as taxes rose, the proportion of companies paying dividends fell from more than 80% in the 1980s to less than 60% by the 2000s. Instead, many companies turned to stock buybacks as a more tax-efficient way to reward shareholders.

Stock buybacks don’t create an immediate tax event for shareholders who don’t sell. Rather, they can increase the stock price, enabling investors to defer taxes until they sell their shares. And when they sell, they often benefit from the lower capital gains tax rate.

The problem is that buybacks prioritize short-term stock price increases over long-term investments. Executives may use them to artificially boost stock prices to qualify for higher compensation. Meanwhile, the government receives fewer tax dollars.

In 2003, the Bush administration passed a tax overhaul introducing “qualified” dividends. By taxing dividends at the lower capital gains tax rate, the legislation attempted to fix an unintended consequence in the tax code and encourage companies to pay dividends.

What is a Qualified Dividend?

The Jobs and Growth Tax Relief Reconciliation Act (JGTRRA) introduced the concept of “qualified” dividends. Under the new rules, these “qualified” dividends are subject to the lower capital gains tax rate, making them much more appealing. The qualified dividend tax rate will be at 0% for low-income earners, 15% for average earners, and 20% for high-income earners. The exact breakpoints will adjust annually, but you will always pay less taxes on Qualified dividends.

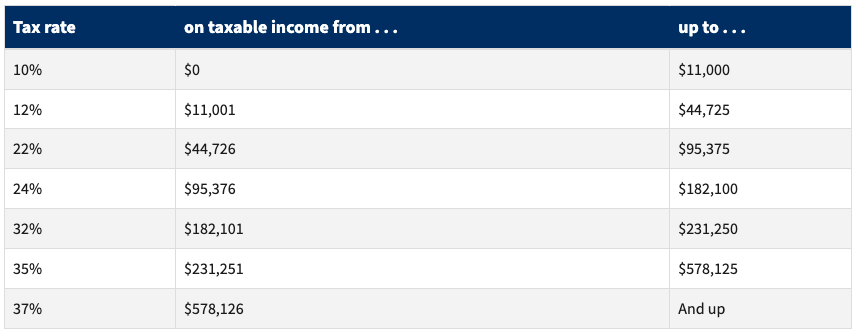

Single taxpayer tax brackets for ordinary income. Source: IRS

Of course, there are a few rules to follow:

- The companies paying the dividends are U.S. companies or foreign companies that trade in the U.S. or have a tax treaty with the U.S.

- You must hold the stock for more than 60 days during the 121-day period that starts 60 days before the ex-dividend date.

In short, you only realize qualified dividends when you invest in U.S. companies and hold them for at least a few months. The government wants to make sure that you’re trading U.S. stocks as a long-term investor and not an opportunistic short-term trader.

It’s also worth noting that not all U.S. companies pay qualified dividends. For instance, REITs and MLPs typically don’t qualify (and may have lower tax rates anyway), while many money market funds and bond-like securities don’t meet the criteria.

Reporting Taxes on Dividends

Qualified dividends can have a significant impact on your after-tax returns.

For instance, if you earn $100,000 per year, you fall into the 24% tax bracket for some of your income. So, if you have $10,000 in dividend income, you could save $900 in taxes in a single year by having that income in qualified dividends!

Fortunately, you don’t have to determine whether each dividend is ordinary or qualified when filling out your taxes. Your broker should provide you with a Form 1099-DIV that tells you the qualified versus ordinary status.

Most brokers provide taxable account holders a Consolidated 1099 or Composite 1099. It will include a section labeled Form 1099-DIV reporting your dividend income. This will include a breakdown between Ordinary dividend and Qualified dividend payments. These detailed tax reports also include common sections like the 1099-INT reporting interest payments and the 1099-B to report brokerage transactions with realized gains and losses. Your broker is required to provide this report by mid-February.

Tips for Minimizing Your Dividend Tax Rate

Understanding the distinction between qualified and ordinary dividends is only one way to minimize the taxes you pay on your income-focused portfolio. By implementing other tax strategies, you can potentially keep more of your dividend income and optimize your overall investment strategy to maximize your after-tax returns.

Here are some strategies that can help you minimize your dividend tax bill:

- Prioritize qualified dividends. Hold dividend-paying stocks for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date to qualify for the lower qualified dividend tax rate.

- Utilize tax-advantaged accounts. Hold high-dividend stocks in tax-advantaged accounts like IRAs or 401(k)s to defer or avoid taxes on dividends.

- Hold foreign stocks in IRAs. Hold foreign stocks in IRAs to avoid foreign dividends withhold taxes that can’t be recovered in taxable accounts.

- Optimize your income bracket. Time your income realization to stay within lower tax brackets, especially for qualified dividends and long-term capital gains.

- Consider alternatives. High income earners might consider investing in municipal bonds or alternatives, which may be tax-free at the federal level (and sometimes even the state level).

Of course, before taking any action, always consult with a qualified tax professional since individual circumstances can greatly affect the appropriateness and effectiveness of any tax strategy.

The Bottom Line

Understanding the difference between ordinary and qualified dividends can significantly impact your after-tax returns. Qualified dividends, introduced in 2003, are taxed at the lower capital gains rate, offering a substantial tax advantage over ordinary dividends.

You can realize these lower rates by holding U.S. or qualifying foreign stocks for at least 61 days around the ex-dividend date. And, for even more tax savings, you can use a tax-advantaged account and optimize your income brackets.

If you’re a dividend investor, you should also consider using our dividend tracker to monitor your portfolio, project your income, and stay on top of your investments. Our dividend screener can also help you find opportunities that meet your criteria.